Your credit report and credit score are ways of keeping track of and evaluating how you use credit.

First, some definitions:

Definitions

- A credit report is a report based on your credit history. It is one of the main tools lenders use to decide whether or not to give you credit.

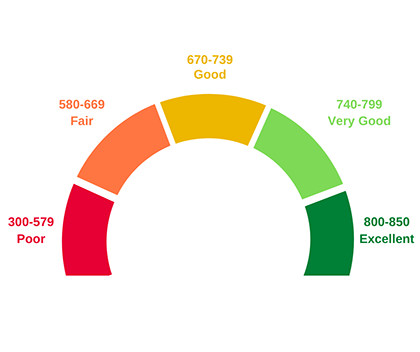

- A credit score is a number that expresses your credit information at one point in time. It indicates the risk you represent for lenders, compared with other consumers, on a scale from 300 to 900. High scores on this scale are good. The higher your score, the lower the risk for the lender.

Why do your credit report and credit score matter? Because lenders want to know how you have handled credit in the past to determine how well you are likely to handle it in the future.

- Credit card issuers, auto dealerships and mortgage lenders will check your credit score before deciding how much they are willing to lend you and at what interest rate.

- Insurance companies, landlords and employers may also look at your credit report to see how financially responsible you are before issuing an insurance policy, renting out an apartment or giving you a job.

If you have a poor credit rating or credit score:

- you may be denied credit or you may need to obtain a co-signer to be approved for credit

- you may have to pay a higher interest rate

- you may not be able to rent the apartment or get the job you want.

Tip

Get a copy of your credit report every year and correct any mistakes you find.If you believe that the information in your credit report is incorrect, contact the credit reporting agency and your financial institution. If the financial institution says that the information reported is correct but you are still not satisfied, you can submit a brief statement to the credit reporting agency. If the error came from your financial institution and the institution will not correct the error, you can file a complaint with the institution.

You can get a copy of your credit report by mail for free, or online for a fee. The only way to obtain your credit score is online. There is a fee.

Equifax Canada

- National Consumer Relations

P.O. box 190, Station Jean-Talon,

Montreal, Quebec H1S 2Z2

Toll-free: 1-800-465-7166

TransUnion

- Attention: Consumer Relations

3115 Harvester Road, Suite 201

Burlington, Ontario L7N 3N8

Toll-free: 1-800-663-9980